Bitcoin tracking firm, Chainalysis, reveals that law enforcement organizations are set to increase the number of arrests of cyber gangs behind ransomware attacks.

In the course of the last six months, ransomware has become one of the most dangerous, not to say #1, cyber threats not only to individual users but to businesses, government organizations and the healthcare sector as well. Chainalysis, however, hopes things could still turn around.

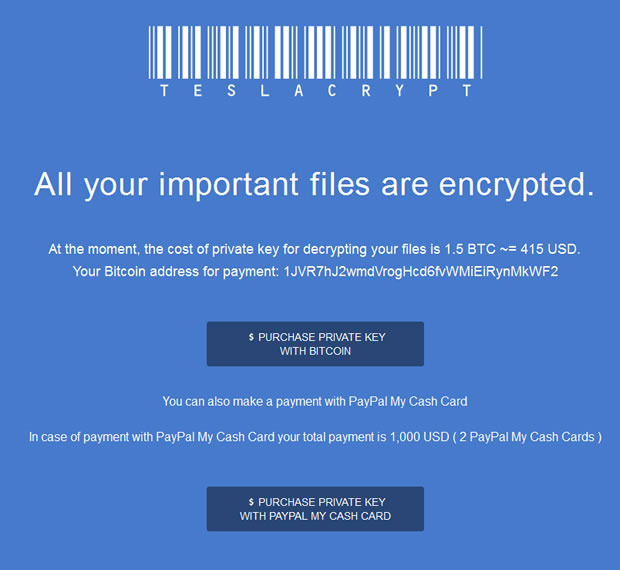

Ransomware crooks are targeting users with their malicious products (malware or threatening Distributed Denial of Service (DDoS) attacks). By encrypting victims` valuable data they blackmail them for money, usually demanding the payment to be done in bitcoin to avoid being exposed. However, for a couple of years now, law enforcement agencies from Europe, Asia and the US have been buying Chainalysis bitcoin-tracing technology.

“Expect to see some arrests soon as law enforcement agencies wrap up their investigations into several ransomware operations.” – said the CEO and co-founder of Chainalysis, Michael Gronager.

“The ransomware industry is probably worth more than $100bn (£76bn) a year, but hopefully our technology will help to reduce and contain that as people are arrested and sent to jail.” – he shared with Computer Weekly.

With the help of the Chainalysis technology, authorities have already managed to make some arrests, including one of the cyber gang going by the name DD4BC (DDoS for bitcoin).

“Bitcoin transactions used to be anonymous, but our software is capable of linking the source and recipient, so, in effect, bitcoin has become less anonymous than cash.” – continues Gronager- “As Chainalysis software becomes more widely deployed, the number of jurisdictions in which cyber criminals can use bitcoins with impunity will be very limited.”

According to Gronager, the recent theft of about $66 million in bitcoins from the Hong Kong-based Bitfinex exchange was a huge mistake by the crooks.

“Whoever took those bitcoins has a bit of a problem because the minute they use them, we will be able to trace them,” – he said – “It is a bit like sitting on a pile of marked banknotes.”

Gronager and his two co-founders, Dane Jan Moller (chief technology officer) and Briton Jonathan Levin (chief revenue officer), were all working in the bitcoin exchange industry. Because of the unacceptable fact there were no actual tools to assess risks involved in bitcoin transactions, they decided to establish Chainalysis. It took them only a couple of months to build the tool.

“Banks needed a monitoring tool to identify money-laundering activities and verify if bitcoin transactions were attached to legitimate business activities.” – explains Gronager, who is originally from Denmark.

The tool`s primary aim was to provide money-laundering-preventing systems for financial institutions, that provide banking services to the blockchain industry, and companies, active in the blockchain and bitcoin space. Soon enough, however, its anti-cyber-crime purpose was revealed.

Chainalysis started helping the San Diego police with several bitcoins-involving cases. In the working process it quickly got in touch with other law enforcement organizations not only from the US and as a result, law enforcement now accounts for a significant portion of Chainalysis’ customer base.

Since then, Chainalysis has contributed to several huge and important cases, such as the theft of £250m worth of bitcoins from MtGox in 2014.

With the Chainalysis software law enforcement agencies are able to trace the bitcoins to find out how hackers are going to convert them into cash or other digital currencies. Moreover, a connection between the victims and the how much the crooks are taking could also be estimated.

Even though the identities of Gronager`s customers in law enforcement remain a secret, he said that more than 50% of the European authorities are using the Chainalysis software.

“It is also a matter of public record that our customers include Europol in Europe and the FBI in the US.” -he said.

After taking part in the Barclays accelerator program in 2015 for fintech startups in partnership with incubator firm Techstars, Chainalysis` customer base started to widen in the banking industry after “Working with Barclays has taught us how to engage with the enterprise market.” – stated Gronager – “The accelerator programme also taught us how to raise investment and set up our headquarters in New York City, while Techstars has given us access to its global contacts and a network of several thousand startups, who have helped us to know how to work with certain investors”

Gronager believes that the Chainalysis software is essentially a search engine for blockchain ledgers and it is expected to become a major revenue driver for the company in future.

“In the longer term, we expect blockchain to underlie most financial transactions in future, especially as it can provide unprecedented transparency if you know where to look.” – he said.

Thanks to it, financial institutions are able to receive reports about their customers` blockchain activity to raise issues and alerts. This activity is broken down by different categories which gives the financial institutions the ability to spot emerging threats from the deep web. They can also investigate ransomware or extortion notes in-house and evaluate the risk of doing business with each of their customers.

Gronager said that, in the US alone, there had been over 5,000 suspicious activity reports about bitcoin transactions in the previous year and zero the year before when the software didn’t exist.

BREXIT?

Even though Chainalysis` headquarters are in the US, it has a small presence in Denmark as well. There was a high chance Denmark to become the company’s European center, but with the UK’s Brexit vote, there might be some changes.

“The worst thing about the Brexit vote is that no one really saw it coming, and now we all have to figure out what to do about it.” – said Gronager – “A lot of consultants have been hired in the UK and Brussels to figure out what hit us, so billions of pounds are being wasted on consultants doing paperwork as a result.”

The company, of course, isn’t without any competition. Elliptic and Block Seer firms are also in this branch but Gronager believes that, by getting in early, the company has an advantage in clients and may turn to be the market leader.