The Wall Street Journal reports that more and more people are complaining about receiving fake notices from the Internal Revenue Service (IRS) regarding tax bills tied to the Affordable Care Act (ACA). In the notice, taxpayers are asked to pay a penalty for ACA coverage, which they have elected in 2014. However, the IRS never contacts taxpayers via email so any email of this kind is a scam, for sure.

Some of the notices, on the other hand, are delivered by snail mail. They are pretending to be a CP-2000 notice from the IRS, but legitimate notices are computer-generated letters that ask for payment “based on a mismatch between a taxpayer’s return and what’s reported by a third party, such as interest on a bank account”, reveals the Journal.

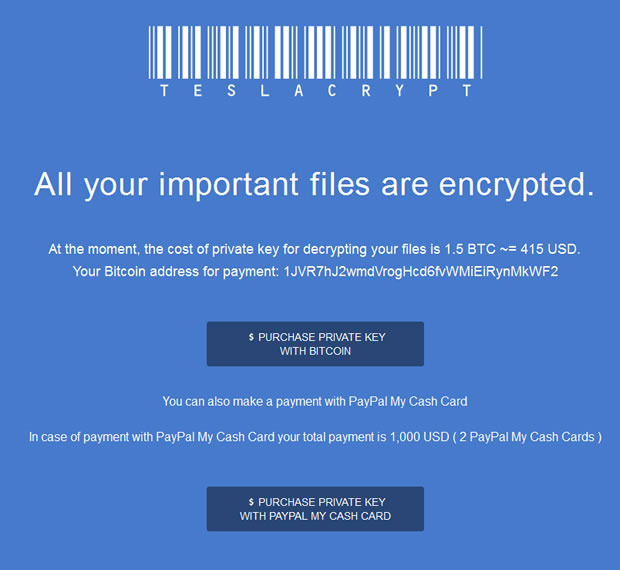

An example of a real CP-2000, provided by the IRS is seven pages long and the fake one is only three pages, demands a $325 payments and includes a “payment voucher”. Below, is a copy of the fake notice, released by the Center for Agricultural Law and Taxation at Iowa State University.

The phony notice uses the language and typefaces used in real IRS letters but it requires the payment to be sent to the “Austin Processing Center”, where the IRS doesn’t have a large center. Moreover, victims are asked to make a check put to “I.R.S.” instead of the correct payee, which is the U.S. Treasury, reports the Journal.

More and more scams are targeting taxpayers and this is the freshest one. 2 million complaints have been sent to the U.S. Treasury Inspector General for Tax Administration since October 2013. The victims report the same scam tactic of receiving a phone call for scammers pretending to the IRS agents. The crooks have managed to deceive more than 8,800 people, according to the Journal, and rip them off with $47 million in total.

Below are a few important facts all users should keep in mind when it comes to IRS:

- The IRS does not initiate contact by phone, email, text, or social media asking for personal or financial information.

- The IRS does not call about taxes owed before first mailing a bill.

- The IRS does not call to demand immediate payment.

- The IRS does not require payment in a certain way, like with a prepaid debit card or an iTunes gift card.

- IRS agents won’t ask for credit or debit-card numbers over the phone.

- The IRS does not threaten to bring in local police or other law-enforcement groups to arrest a taxpayer who owes money.” – the Journal reminds.

If you happen to receive such email do not open it or reply. You should forward it to phishing@irs.gov and then delete it right away. You should also report it to the Federal Trade Commission and Tigta. In a case of receiving a fraudulent phone call, immediately notify the IRS at 800-829-1040.